Reddit Super Bowl Commercial Reminds Us Of The Stonk Market

Ad highlights how everyday people can cause a splash, not only in the financial world, but with anything they care about

February 10, 2021

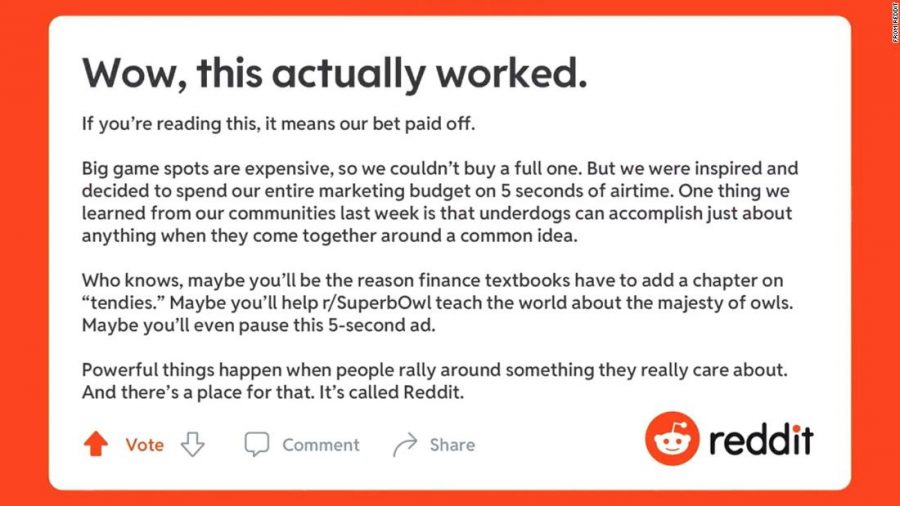

Those who watched the Super Bowl on Sunday will recall a plethora of hilarious commercials accompanying the game. But some may have missed the brief 5-second blip of a commercial from Reddit that addressed the recent stock market Gamestop takeover. While the event has left the public eye, some are still left to wonder- what exactly happened?

Short-selling. Hedge-funds. Reddit. Gamestop. Long ago, the four ideas lived together in harmony. But everything changed when Reddit acted exactly as the market is supposed to, which Wall Street got upset about for some reason.

Hi! If you’re wondering what’s going on in the Stock Market, or as Twitter calls it, The Straight Man’s Zodiac, this is the place for you! Read this, and in a couple of minutes, you’ll have a vague understanding of the dying chaos of the Gamestop short squeeze.

So what is short-selling? Imagine you, a wealthy investor, borrow a peanut from Baby Nut (or as I call him, history’s greatest nut-themed monster). The innocent peanut’s life is worth 50 cents, so you sell this borrowed innocent peanut to history’s greatest dog-themed monster, Scrappy-Doo, who hopes to make money off of the innocent peanut. However, the price of the innocent peanut’s life goes down a few days later, so Scrappy-Doo sells it back to you, at the price of 25 cents which is good because you need to return that borrowed innocent peanut to Baby Nut. But what is significant about this is the difference. You made 25 cents! In the stock market, the innocent peanut is stock, and investors short-sell frequently to make money. To conclude, short-selling is when an investor borrows stock, sells it, then buys it back at a lower price to keep the difference.

But what is a short squeeze? Imagine that after selling that innocent peanut, the price of the innocent peanut’s life goes up by a LOT. You don’t think Scrappy-Doo will be willing to sell you the innocent peanut back, because now he’s making a lot of money, but you still need to return that innocent peanut to Baby Nut. You end up paying a lot of money to get that stock back, so you lose the money you were hoping to gain. How did the price of the innocent peanut’s life go up? Everybody else started buying innocent peanuts, so demand went up! To conclude, a short squeeze occurs when an investor has to buy back borrowed stock at a price higher than what they sold as a result of higher demand for it.

Now we’re almost to the fun part, but there’s one question left: where does the money to buy back all that stock come from? Because (in this story) you’re a wealthy investor, you have access to a hedge fund. Only the mega-wealthy have access to hedge funds, with a required threshold of a $200k yearly income and $1 million net worth. A hedge fund uses a giant pool of money to invest in all sorts of stocks. This means that the wealthy are protected from bad times in the stock market and make a little extra money during good times. For example, if you have a bunch of innocent peanuts, you would also tap into the hedge fund to also buy a bunch of innocent cashews in case people start to prefer cashews. In another example, you could tap into the hedge fund to buy back those stocks you tried to short-sell.

So now we know what short-selling, hedge funds, and short-squeezes are. What does this have to do with Reddit? The website is compiled of multiple subreddits, in which people can discuss and contribute to a certain topic under subreddits. The subreddit called r/WallStreetBets encouraged other Reddit users to buy as much Gamestop Stock as possible, having determined that wealthy Wall Street investors would repeatedly short-sell Gamestop Stock to get extra profits. Therefore, a short squeeze occurred, forcing Wall Street to tap into their hedge funds to get their stocks back, costing them billions of dollars!

Remember the story of Robin Hood, who robbed the rich to steal for the poor? Well, welcome to the Upside-Down, because the trading app Robinhood, in which online investors can buy and sell stock, temporarily made it impossible for investors to purchase Gamestop stock, until they were threatened with lawsuits and made it possible again. So what’s happening now? Plenty of people have sold their Gamestop stock, causing its value to go down as fewer and fewer people buy it. Some faithful Redditors are trying to “ride it to the moon” in the hopes the stock will skyrocket a second time. But let’s be honest, this will likely be a ride to the center of the Earth.

|

Term |

Definition |

In-story example |

| Wall Street Investor | A wealthy investor who makes money by buying and profiting off of stock. | You, Baby Nut, and Scrappy Doo |

| Stock/Shares | Money earned by a business that is shared with people who purchased (invested in) it. | Innocent Peanuts |

| Short/Short-selling | Borrowing a stock from an investor, selling it, and then buying it back at a lower price to make some extra money. | Selling innocent peanuts at a high price and buying them back when their value goes down to get extra money. |

| Short Squeeze | Occurs when normal (called retail investors) make the price of short-sold stocks go up so the short seller has to pay back more money to get it back and return it to the investor they borrowed it from. | More and more people purchase a certain type of stock, making their price go up, forcing the short seller to buy their borrowed sold stock back at a higher price, losing money. |

| Hedge Fund | A group providing a pool of money which can be invested into multiple places in the stock market to protect against financial gain. When it does well, the rich get much richer. When it doesn’t, they are protected by their other investments. | Your pool of safety money, which you can use to invest in alternate types of nuts in case people buy more cashews than peanuts. It is also be tapped into in case the value of your short-sold peanuts quickly goes up and you need money to buy them back. |